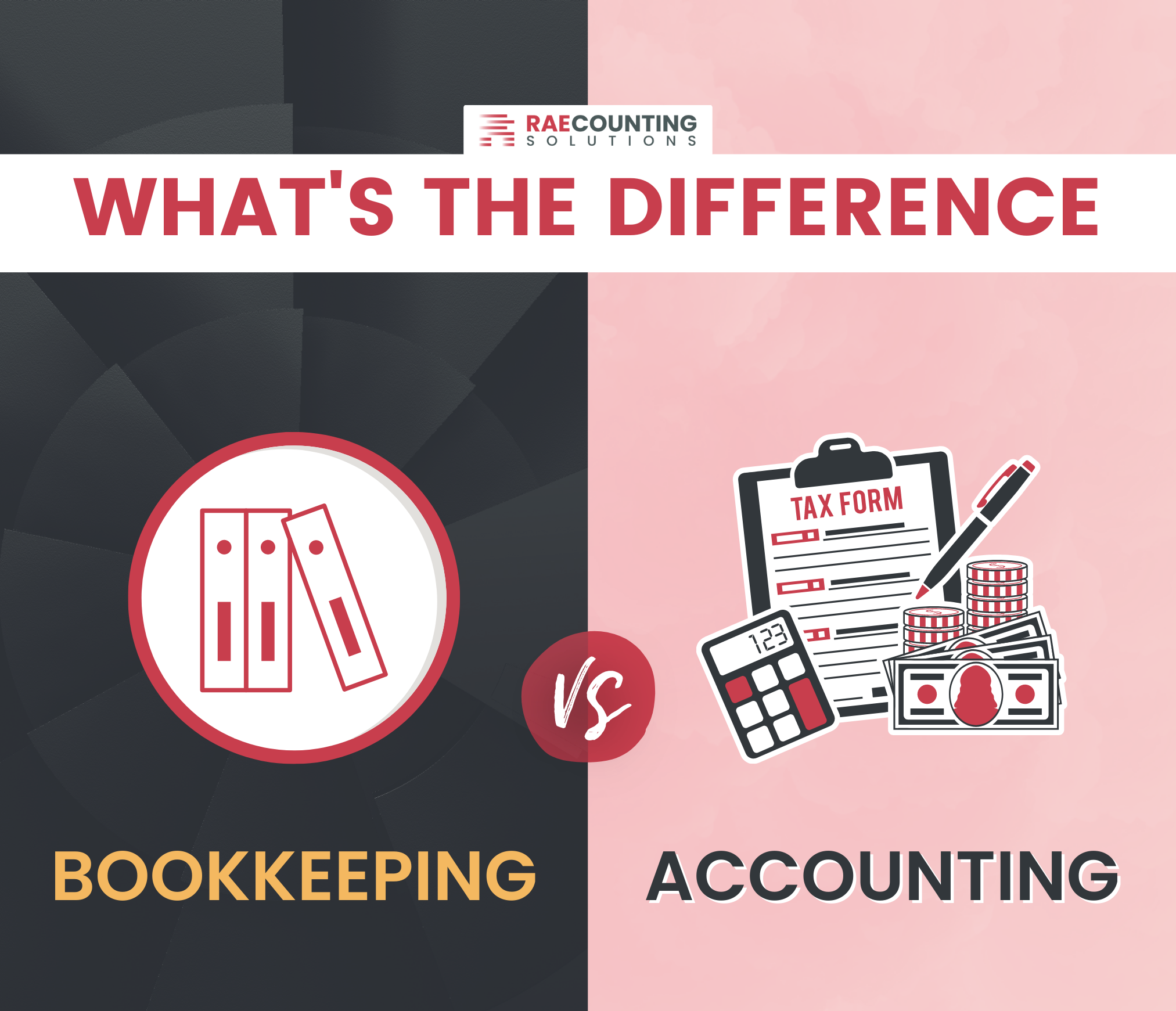

When most people think about the difference between bookkeeping and Accounting, they have a hard time distinguishing between the two processes. Accountants and bookkeepers share common goals but support businesses at different stages of the financial cycle.

Both bookkeeping and accounting are important business functions, but they are not the same thing. There is an important difference between a bookkeeper and an accountant. Here in Raecounting Solutions, will explore the main differences and give you all the information you need about bookkeeping and accounting.

The Similarities of Bookkeeping and Accounting

To the untrained eye, bookkeeping and accounting may look very similar. Both deal with financial transactions and numbers, but there are differences. In some cases, the line between bookkeeping and accounting can blur. Many businesses hire accountants, who do more than record payments and update their books.

Similarly, accountants may be involved in maintaining accounts as well as analyzing information and data provided by clients. Both accountants and bookkeepers have skills in working with numbers, but accountants have higher education and additional qualifications that allow them to offer a wider range of services.

The qualifications required to handle comprehensive accounting processes make an accountant a sort of supervisor for bookkeepers. An accountant may become a consultant to company bookkeepers who ensure financial process accuracy by seeking review and advice. A certified public accountant is a higher expert in the field of accounting, for which the bookkeeper needs only a basic understanding and certification.

The Certified Public Accountant has more in-depth insight into the accounting aspects of a company and can offer feasible business advice. A Certified Public Accountant gives ideas and advice that may call for the modifications of the books to align with cost-practical deduction eligibility scenarios.

The tax accountant has a specialization in the field of taxation and the regulations that come with business mergers, for instance. These accountants may also offer advice on tax structures or tax deductions.

To sum it up, bookkeeping is a stepping stone to the initial stage of accounting procedures, which makes the two inseparable. If the bookkeeping is done properly, it perfectly complements accounting and vice versa. Since bookkeeping tasks are clerical, some knowledge of commerce is enough. On the other hand, accounting is more analytical so thorough knowledge in this field is a prerequisite. Bookkeeping and accounting are inseparable because if bookkeeping is carried out properly, it will only complement accounting.

The Main Differences between Bookkeepers and Accountants

A major misconception regarding bookkeeping vs. accounting is that both are considered to be one profession. Though they seem to be very similar, there are some striking differences between the two. To resolve this confusion, we have listed the main differences between the two.

Work Definition

Bookkeeping is mainly related to identifying, measuring, and recording financial transactions while accounting is the process of summarizing, interpreting, and communicating financial transactions which were classified in the ledger account.

Responsibilities

Bookkeepers are responsible for maintaining and balancing subsidiaries, general ledgers, and historical accounts. Meanwhile, Accountants provide financial analysis and strategy.

Basically, the process of bookkeeping does not require any analysis. Accounting will use bookkeeping information to analyze and interpret the data and then compile it into reports which will provide a better view of your business finances.

Role Qualifications

A bookkeeper does not need to have specific formal education requirements and instead prioritize past clerical work experience. Bookkeeping courses and college experience can make you a more competitive candidate. As for accounting, most employers require at least a bachelor’s degree in accounting or a related financial field. Accountants can also take the Uniform Certified Public Accountant Exam to become CPAs, and many earn their master’s degrees.

The Limitations

Undertaking a few accounting courses and gaining a basic understanding of accounting will qualify a person for bookkeeping. However, like what has mentioned. Accountants should obtain a degree in finance and accounting and should also be certified as an accountant before practicing. While accountants are qualified to handle the entire accounting process, bookkeepers would only be able to handle the recording of financial transactions. Many a time, you would find accountants serving as advisors for bookkeepers and even reviewing their work. Bookkeepers on the other hand lay the groundwork for accountants so that they can expertly evaluate the financial data of an enterprise.

Conclusion

Few organizations learn to manage their finances on their own. Furthermore, few choose to employ a professional so the administration can concentrate on the other functions of the business. As your business grows, it’s essential to have trusted financial professionals managing your books and providing strategic financial advice.

After all, the busier you get, the more complex financial management becomes, and the less time you’ll have to maintain your books and try to make sense of all the data.

A trustworthy bookkeeper’s services are essential for a thriving business, and an accountant can do so much more than handle your taxes. Think of your accountant as a trusted business partner, someone whose services you rely on year-round for advice on how to increase profitability as you take steps to achieve your business goals.